Are you feeling overwhelmed by debt? You're not alone. Millions of people battle with debt issues every day. The good news is that there are proven strategies to achieve control of your finances and find relief. This article will explore expert solutions to help you on the path to financial freedom.

First, it's crucial to create a comprehensive budget. Track your income and expenses to determine areas where you can cut spending. Next, consider consolidating your debts into a single loan with a lower interest rate. This can simplify payments and reduce your overall interest costs.

Seeking to a reputable credit counseling agency can also provide valuable assistance. They can help you develop a personalized debt management plan and bargain with creditors on your behalf. Remember, tackling debt requires dedication, but with the right strategies and support, you can attain financial security and peace of mind.

Never hesitate to seek help when you need it. There are resources available to empower you in your journey to financial freedom.

Consolidate Your Debts for Lower Interest Rates

Are you struggling to manage multiple debt payments? Think about debt consolidation as a potential approach. This involves merging your existing debts into a single, simplified loan with a potentially lower interest rate. By consolidating your debts, you can reduce your overall interest payments, simplifying the process to stay on top of your finances.

- Benefits of debt consolidation include:

- Lower monthly payments

- Reduced interest costs

- Simplified repayment schedule

Claim Financial Independence: Customized Debt Management Solutions

Are you feeling overwhelmed by financial obligations? You're not alone. Many individuals struggle with managing their debt and achieving financial freedom. Fortunately, there are personalized debt settlement strategies that can help you get back on track. A skilled financial advisor can assess your unique situation and craft a customized plan to minimize your debt burden. This may involve bargaining with creditors, combining your debts, or considering other options such as debt management programs.

- Achieving financial freedom involves more than just paying off debt.

- It's about taking ownership of your finances and building a secure future.

By implementing a personalized debt settlement strategy, you can aim to enhance your credit score, free up more cash flow, and achieve your financial goals.

Work with Creditors: Achieve Equitable Debt Settlements

Facing a mountain of debt can feel overwhelming, yet you're not alone. Many individuals and families struggle with credit card debt at some point in their lives. The good news is that there are strategies you can use to obtain control of your finances and strive for a more stable future. One of the most powerful tools in your arsenal is negotiation.

By embarking on the initiative to converse with your creditors, you can often secure mutually beneficial agreements that ease your financial burden.

- Grasp your current debt situation: Evaluate of all your outstanding debts, including the APR. This will give you a clear picture of what you're dealing with.

- Formulate a negotiation strategy: Research your creditors' policies and practices regarding debt settlements. Determine what you're willing to contribute, and define your desired outcome.

- Contact professionally: When speaking with your creditors, be polite, courteous, and explicit in your communication. Highlight your willingness to resolve the debt, but also assert your need for a fair settlement.

- Consider alternative options: If you're unable to reach a satisfactory agreement with your creditors, research other debt resolution options, such as bankruptcy.

Bear in mind that you have rights as a debtor, and fail to to seek professional guidance if needed. A debt management can provide valuable assistance throughout the process. By undertaking a proactive approach and communicating with your creditors, you can strive towards a more manageable and secure financial future.

Dispute Unfair Debts: Protect Your Rights, Reclaim Your Finances

Are you facing with a claim that feels inaccurate? You're not isolated. The legal system is there to protect your standing when it comes to creditors. By actively disputing questionable debts, you can restore control of your monetary future.

Learn the processes to refute a debt and enforce your protections. We'll assist you on how to proactively navigate this situation and obtain a favorable outcome.

- Consider action swiftly. The longer you wait, the more complex it may become to resolve the issue.

- Document all proof related to the debt, including correspondence.

- Communicate to the debt collector in writing, explicitly stating your dispute and the grounds behind it.

Remember that you have guarantees when it comes to debt collection. Don't be pressured. By recognizing your options and taking the right measures, you can protect your financial security.

Smash Your Debt Burden: A Step-by-Step Guide to Resolution

Drowning in dues? Feeling stressed by the weight of your outstanding payments? You're not alone. Many people struggle with debt, but it doesn't have to control your life. With a well-planned strategy, you can take charge yourself and achieve independence. This step-by-step guide will provide the tools and knowledge you need to eliminate your debt and build a brighter financial future.

- First, assess your current financial situation. Make a comprehensive record of all your loans, including the balance, interest rates, and minimum monthly payments.

- Develop a realistic budget. Track your income and outgoings to identify areas where you can reduce money.

- Rank paying off your loans strategically. Consider using the debt consolidation to manage your payments effectively.

- Consider expert guidance if you need assistance with creating a debt management plan or exploring solutions such as bankruptcy.

Be patient and persistent . It requires discipline, but the rewards are well worth the effort. Take control ofyour finances today and pave the way for a more secure and prosperous future.

Reclaim Your Financial Future: Effective Debt Management Services for Everyone

Are you feeling stressed by debt? You're not alone. Millions of people struggle with managing their finances, but there are solutions available to help you break free from debt. Effective debt management services can provide the guidance you need to consolidate your debts and regain control of your money.

These services often involve a variety of options, such as creating a personalized budget, negotiating with creditors on your behalf, and exploring debt consolidation programs. A qualified debt management expert can assess your situation and develop a tailored plan to meet your specific goals.

Taking the first step towards debt management can be challenging, but it's a crucial action that will have a lasting impact on your financial well-being. Don't let debt control your life any longer. There are resources Debt Settlement available to help you achieve financial freedom.

- Research reputable debt management services in your area.

- Schedule a free consultation with a financial expert to discuss your options.

- Seize the opportunity by starting your journey towards financial stability today.

Don't Let Debt Control Your Life: Take Charge

Are you swamped in debt? Feeling overwhelmed by payments and constantly anxious? You don't have to allow to debt control your life! At [Company Name], we offer proven solutions tailored to individual needs. We'll work with you to design a personalized approach that helps you achieve financial freedom.

- Discover our wide range of financial solutions.

- Acquire expert guidance from dedicated team of consultants.

- Make the first step towards a debt-free financial future.

Don't hesitate any longer! Reach out with us today for a no-obligation consultation.

Debt Relief Made Easy: Affordable and Proven Methods

Overwhelmed by escalating debt? You're not alone. Millions of people are struggling with similar monetary burdens. The good news is that there are budget-friendly methods available to help you regain control of your finances and achieve burden relief.

Methods like debt consolidation, balance transfers, and credit counseling can significantly reduce your monthly payments and make it feasible to settle your debt.

These proven approaches are designed to be adjustable to your individual circumstances. A certified financial advisor can help you determine the best strategy for your specific financial state.

Don't let debt control your life. Initiate the first step towards financial freedom by exploring these accessible debt relief options today.

Say Goodbye to Stressful Collections Calls

Are you dreading incoming collections calls? Let us help you through the process with our skilled team. We understand that collections can be a tough time, and we're here to lessen the burden. With our compassionate and reliable approach, you can find relief from worry.

- You'll benefit from a range of solutions to fit your unique needs.

- Our goal is to clear and transparent communication throughout the entire process.

Don't let collections calls control your life. Reach out to us now and experience the difference a reliable collections partner can make.

Begin Your Journey to Financial Wellness: Uncover Your Debt Solutions

Are you feeling overwhelmed by debt? It's common to feel stressed when facing a mountain of money owed. The good news is, there are methods available to help you regain control and work towards financial freedom. Taking the first step towards understanding your debt can be daunting, but it's essential for creating a sustainable financial foundation.

Exploring your choices is crucial. A debt specialist can provide customized advice based on your unique situation. They can help you understand your current debt, explore reduction programs, and develop a practical strategy to get back on track.

- Don't to seek professional help.

- Remember that you are not alone in this journey.

- Take control by learning about your debt and exploring your options.

By getting started, you can transform your financial future.

Bradley Pierce Then & Now!

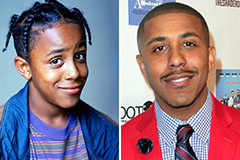

Bradley Pierce Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!